Home / Home Improvement Loan

Transform Your Home with a SunStar Lending Home Improvement Loan

Get the funds you need to upgrade, renovate, or remodel with personalized loan solutions.

- Flexible loan amounts and repayment terms that fit your project

- Fast, secure, and easy application process so you can get started quickly

- Highly competitive rates with no hidden fees, ensuring complete transparency

WHY SUNSTAR LENDING

Why Choose SunStar Lending for Your Home Improvement Loan

Experience the flexibility and convenience of SunStar Lending home improvement loans, designed to help you transform your home.

Comprehensive Financial Assessment

We consider more than just your credit score. We evaluate your full financial picture, including employment and income, to offer personalized loan rates tailored to your situation.

Custom Loan Options

Choose from loan amounts between $1,000 and $50,000, designed to fit your unique needs, whether it’s for a major purchase, debt consolidation, or an emergency expense.

Flexible Terms and Competitive Rates

Enjoy flexible repayment terms of 3 or 5 years with interest rates ranging from 4.6% to 35.99% APR, allowing you to manage your loan on your own terms.

No Prepayment Fees

Pay off your loan early with zero penalties or hidden fees, giving you the freedom to manage your debt at your own pace.

HOW IT WORKS

Your Path to Financial Success

Experience a seamless process for obtaining a loan, with personalized support from application to fast approval. Let us help you achieve your financial goals!

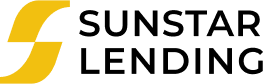

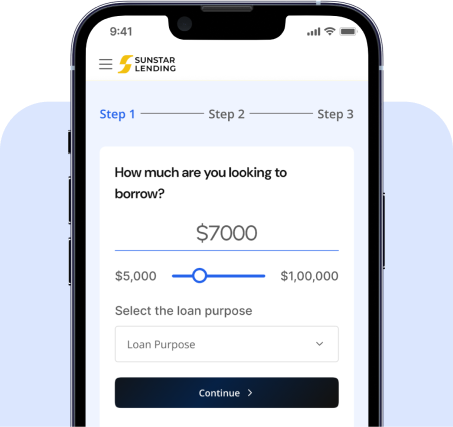

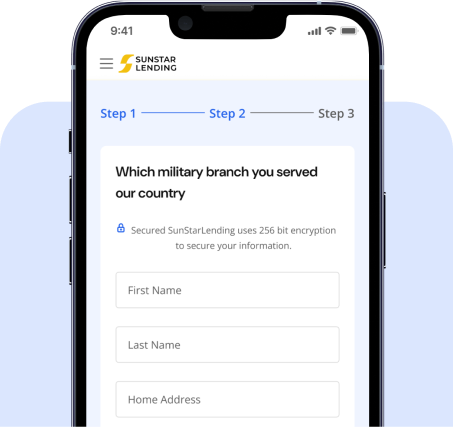

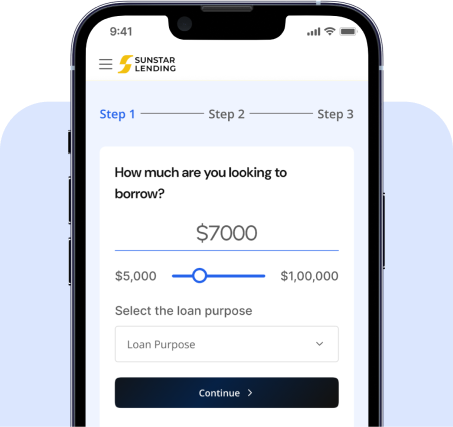

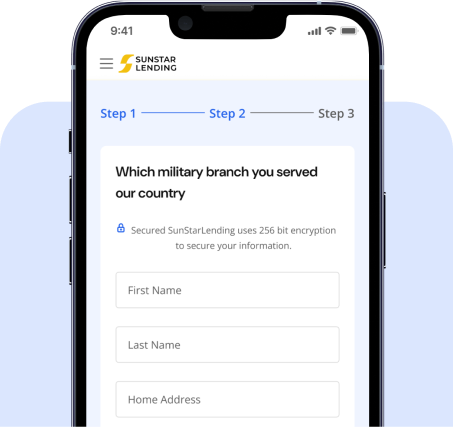

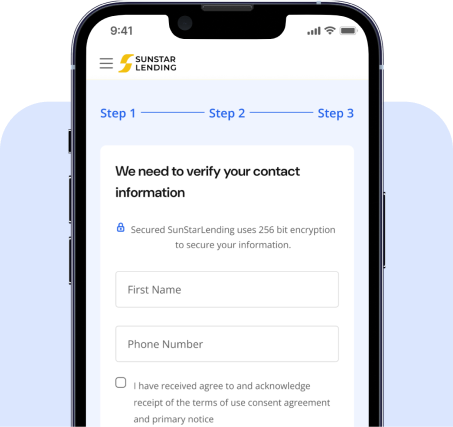

Simple and Secure Application Process

Begin by submitting your basic information through our secure online form. Let us know the best time to connect with you, ensuring that our loan specialists reach out at your convenience. Your personal information is fully protected throughout the process.

Personalized Financial Consultation

Once we receive your application, you’ll have a one-on-one consultation with a loan expert. Together, you’ll explore loan options, terms, and rates tailored to your financial situation. Our experts will help guide you through the best options for your needs. If eligible, you’ll proceed to the approval stage.

Fast & Secure Loan Approval

After consultation, you’ll receive a prompt decision on your loan. If approved, 99% of funds are transferred directly to your account within one business day. It’s that fast and simple! Start your financial journey today with SunStar Lending.

Simple and Secure Application Process

Submit your basic information through our secure form. Let us know the best time for us to reach out, ensuring our loan specialists connect with you at your convenience. your personal details are fully protected.

Personalized Financial Consultation

Talk to a loan specialist about your financial goals and explore loan options, terms, and rates. Get expert guidance on the best products for your needs. If you qualify, move forward with the application for approval.

Fast & Secure Loan Approval Decision

Receive your loan approval decision promptly. If approved, 99% of funds are transferred directly to your account within one business day. Start your journey to financial freedom today with LendXpress!

TESTIMONIALS

What Our Customers Are Saying

Read testimonials from our satisfied customers and see how SunStar Lending has supported them through their financial journeys.

SunStar Lending made the loan process simple and stress-free. The approval was fast, and the customer support team was incredibly helpful. I feel secure with my financial future now!

Alex M

I’m so grateful for SunStar Lending! Their flexible repayment options gave me the breathing room I needed, and the low rates made it affordable. The whole experience was smooth.

Jordan E.

The team at SunStar Lending went above and beyond to make sure I got the right loan for my needs. The process was quick, and the service was outstanding. Highly recommend!

Samantha T.

FAQ

Frequently asked questions

We’ve answered some of the most common questions to help guide you through the process. If you have additional questions, feel free to reach out to our team for more information!

What can I use a home improvement loan for?

A home improvement loan can be used for a wide range of projects, including renovations, repairs, upgrades, and remodeling. You can use the funds to update your kitchen, add an extension, replace a roof, or even enhance your home’s energy efficiency.

How long does it take to receive funds from a home improvement loan?

Once approved, most borrowers receive the funds within 1-2 business days. The exact timing depends on your bank’s processing times, but SunStar Lending works quickly to ensure you can start your home improvement project as soon as possible.

Can I pay off my personal loan early?

Yes, you can pay off your loan early without any prepayment penalties. This flexibility allows you to manage your loan and pay it off ahead of schedule if your financial situation allows.

Will a home improvement loan increase my home’s value?

While home improvement loans can be used for a variety of upgrades and renovations, certain projects—like kitchen remodels, bathroom renovations, or energy-efficient upgrades—can significantly increase your home’s value. It’s important to prioritize projects that provide the best return on investment if your goal is to enhance the overall value of your property.

How does the home improvement loan application process work?

The application process is simple and streamlined. You start by filling out an online application with basic personal and financial information. Once submitted, our team reviews your details and provides an offer if you’re approved. Once you agree to the terms, the funds are disbursed directly to your account.

Can I qualify for a personal loan with bad credit?

Yes, we work with borrowers who have various credit scores. While a higher credit score may help you secure better rates, SunStar Lending considers other factors such as income, employment, and your overall financial situation when reviewing your application.

Are there any fees associated with home improvement loans?

There are no fees to apply for a home improvement loan. Any applicable fees, such as origination fees or late payment penalties, will be clearly outlined in your loan agreement. We pride ourselves on transparency, so you’ll know exactly what to expect without any hidden costs.

Can I use a home improvement loan for emergency repairs?

Yes, a home improvement loan can be used for emergency repairs such as fixing a broken roof, plumbing issues, or structural damage. These loans provide quick access to funds, helping you address urgent repairs without delay and prevent further damage to your home.

BLOGS & ARTICLES

Our Latest News and Insights

Explore latest news and insights. Get our latest tips to stay smart about your money!

Subscribe for expert advice on managing debt and more.

Subscribe for expert advice on managing debt and more.

OTHER LOAN OPTIONS