Home / Personal Loan

Unlock Your Financial Potential with SunStar Lending Personal Loans

Get fast, personalized loan solutions designed to meet your needs.

- Flexible loan amounts and repayment terms to suit your budget

- Fast and secure application process for a hassle-free experience

- Competitive rates with complete transparency and no hidden fees

WHY SUNSTAR LENDING

Why Choose SunStar Lending for Your Personal Loan

Discover the flexibility and convenience of SunStar Lending’s personal loans, designed to meet your financial goals and empower you on your journey.

Comprehensive Financial Assessment

We consider more than just your credit score. We evaluate your full financial picture, including employment and income, to offer personalized loan rates tailored to your situation.

Custom Loan Options

Choose from loan amounts between $1,000 and $50,000, designed to fit your unique needs, whether it’s for a major purchase, debt consolidation, or an emergency expense.

Flexible Terms and Competitive Rates

Enjoy flexible repayment terms of 3 or 5 years with interest rates ranging from 4.6% to 35.99% APR, allowing you to manage your loan on your own terms.

No Prepayment Fees

Pay off your loan early with zero penalties or hidden fees, giving you the freedom to manage your debt at your own pace.

HOW IT WORKS

Your Path to Financial Success

Experience a seamless process for obtaining a loan, with personalized support from application to fast approval. Let us help you achieve your financial goals!

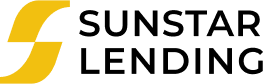

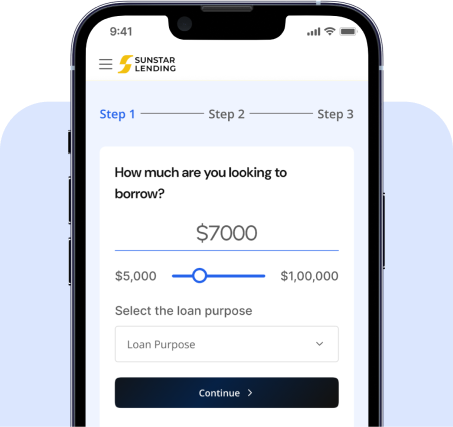

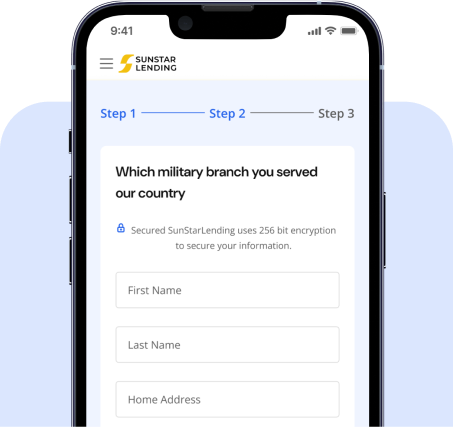

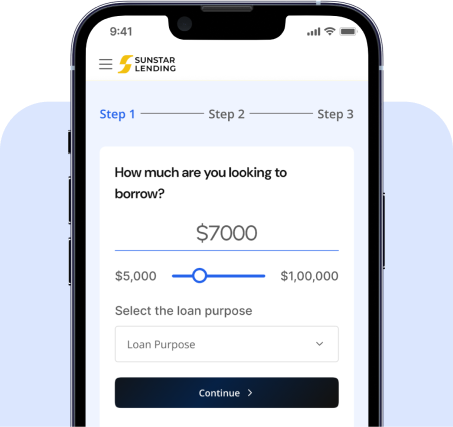

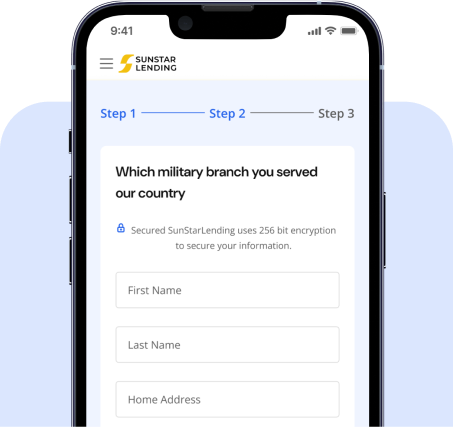

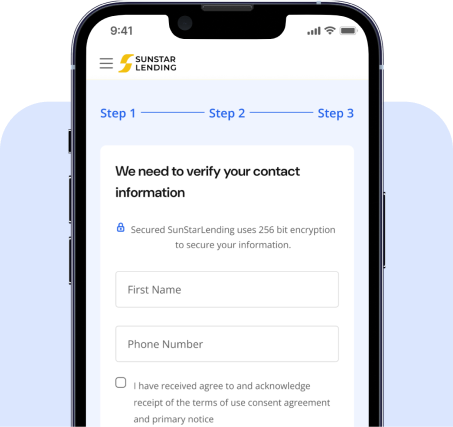

Simple and Secure Application Process

Begin by submitting your basic information through our secure online form. Let us know the best time to connect with you, ensuring that our loan specialists reach out at your convenience. Your personal information is fully protected throughout the process.

Personalized Financial Consultation

Once we receive your application, you’ll have a one-on-one consultation with a loan expert. Together, you’ll explore loan options, terms, and rates tailored to your financial situation. Our experts will help guide you through the best options for your needs. If eligible, you’ll proceed to the approval stage.

Fast & Secure Loan Approval

After consultation, you’ll receive a prompt decision on your loan. If approved, 99% of funds are transferred directly to your account within one business day. It’s that fast and simple! Start your financial journey today with SunStar Lending.

Simple and Secure Application Process

Submit your basic information through our secure form. Let us know the best time for us to reach out, ensuring our loan specialists connect with you at your convenience. your personal details are fully protected.

Personalized Financial Consultation

Talk to a loan specialist about your financial goals and explore loan options, terms, and rates. Get expert guidance on the best products for your needs. If you qualify, move forward with the application for approval.

Fast & Secure Loan Approval Decision

Receive your loan approval decision promptly. If approved, 99% of funds are transferred directly to your account within one business day. Start your journey to financial freedom today with LendXpress!

TESTIMONIALS

What Our Customers Are Saying

Read testimonials from our satisfied customers and see how SunStar Lending has supported them through their financial journeys.

SunStar Lending made the loan process simple and stress-free. The approval was fast, and the customer support team was incredibly helpful. I feel secure with my financial future now!

Alex M

I’m so grateful for SunStar Lending! Their flexible repayment options gave me the breathing room I needed, and the low rates made it affordable. The whole experience was smooth.

Jordan E.

The team at SunStar Lending went above and beyond to make sure I got the right loan for my needs. The process was quick, and the service was outstanding. Highly recommend!

Samantha T.

FAQ

Frequently asked questions

We’ve answered some of the most common questions to help guide you through the process. If you have additional questions, feel free to reach out to our team for more information!

What can I use a personal loan for?

A personal loan can be used for a wide range of purposes, including consolidating high-interest debt, covering unexpected medical expenses, funding home improvement projects, or even financing a wedding or vacation. Essentially, once you are approved, the funds are yours to use as needed, giving you the flexibility to address whatever financial situation you’re facing.

How long does it take to receive funds from a personal loan?

Once your loan application is approved, you can typically expect to receive the funds in your account within one to two business days. The exact timing can depend on factors such as your bank’s processing times, but SunStar Lending aims to disburse funds as quickly as possible so you can use them when you need them most.

Can I pay off my personal loan early?

Yes, with SunStar Lending, you can pay off your loan early without incurring any prepayment penalties. This gives you the flexibility to save on interest by paying off the loan faster if your financial situation improves, allowing you to manage your debt on your terms.

What credit score do I need to qualify for a personal loan?

SunStar Lending works with borrowers of all credit scores, so you don’t need a perfect score to qualify. While a higher score may help you secure better rates, we also consider other factors such as your income, employment status, and overall financial health. Our goal is to provide flexible options to meet your specific financial situation.

How does the personal loan application process work?

The process is simple and straightforward. Start by filling out an online application with basic information about yourself and your financial needs. After submitting your application, our loan specialists will review your details and contact you if any further information is needed. If approved, you’ll receive the loan offer, and once you agree to the terms, the funds will be deposited into your account.

Can I qualify for a personal loan with bad credit?

Yes, we understand that not everyone has a perfect credit history. SunStar Lending works with borrowers across a wide range of credit scores. While your credit score is a factor, we also consider other aspects of your financial situation, such as your income and employment history. We are committed to finding solutions that work for your unique circumstances.

Are there any fees associated with personal loans?

At SunStar Lending, we believe in transparency. There are no fees to apply for a loan, and all potential fees—such as origination fees or late payment fees—will be clearly outlined in your loan agreement. We pride ourselves on having no hidden charges, so you’ll always know what to expect.

Are personal loan interest rates fixed or variable?

At SunStar Lending, personal loan interest rates are typically fixed, meaning your interest rate will stay the same throughout the loan term. This ensures consistent monthly payments, making it easier to manage your budget and avoid any surprises down the road.

BLOGS & ARTICLES

Our Latest News and Insights

Explore latest news and insights. Get our latest tips to stay smart about your money!

Subscribe for expert advice on managing debt and more.

Subscribe for expert advice on managing debt and more.

OTHER LOAN OPTIONS