Home / Consolidation Loan

Take Control of Your Finances with a SunStar Lending Consolidation Loan

Simplify your debt and manage it more effectively with personalized loan solutions.

- Flexible loan amounts and repayment terms tailored to your needs

- Fast, secure, and easy application process for quick access to funds

- Competitive rates with full transparency and no hidden fees

WHY SUNSTAR LENDING

Why Choose SunStar Lending for Your Consolidation Loan

Simplify your debt and regain control of your finances with a tailored consolidation loan from SunStar Lending.

Comprehensive Financial Assessment

We consider more than just your credit score. We evaluate your full financial picture, including employment and income, to offer personalized loan rates tailored to your situation.

Custom Loan Options

Choose from loan amounts between $1,000 and $50,000, designed to fit your unique needs, whether it’s for a major purchase, debt consolidation, or an emergency expense.

Flexible Terms and Competitive Rates

Enjoy flexible repayment terms of 3 or 5 years with interest rates ranging from 4.6% to 35.99% APR, allowing you to manage your loan on your own terms.

No Prepayment Fees

Pay off your loan early with zero penalties or hidden fees, giving you the freedom to manage your debt at your own pace.

HOW IT WORKS

Your Path to Financial Success

Experience a seamless process for obtaining a loan, with personalized support from application to fast approval. Let us help you achieve your financial goals!

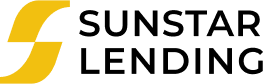

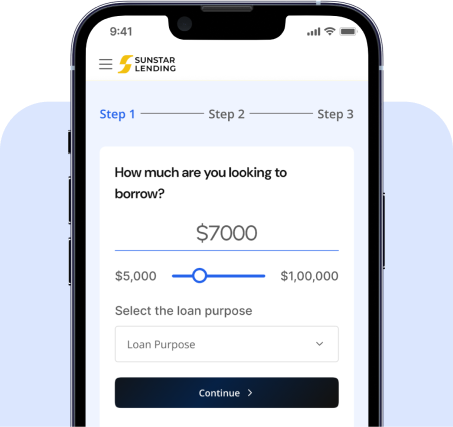

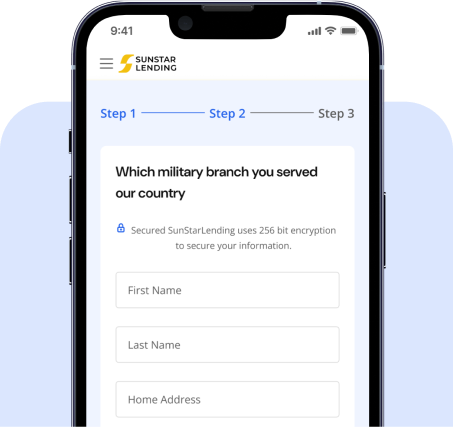

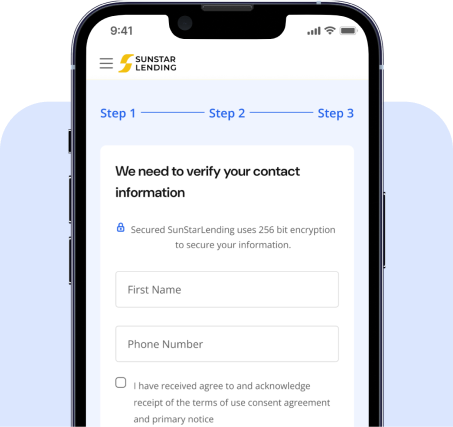

Simple and Secure Application Process

Begin by submitting your basic information through our secure online form. Let us know the best time to connect with you, ensuring that our loan specialists reach out at your convenience. Your personal information is fully protected throughout the process.

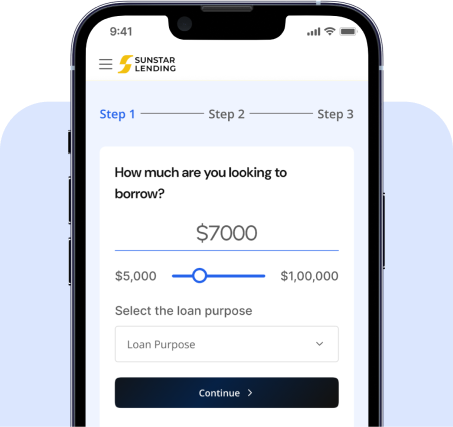

Personalized Financial Consultation

Once we receive your application, you’ll have a one-on-one consultation with a loan expert. Together, you’ll explore loan options, terms, and rates tailored to your financial situation. Our experts will help guide you through the best options for your needs. If eligible, you’ll proceed to the approval stage.

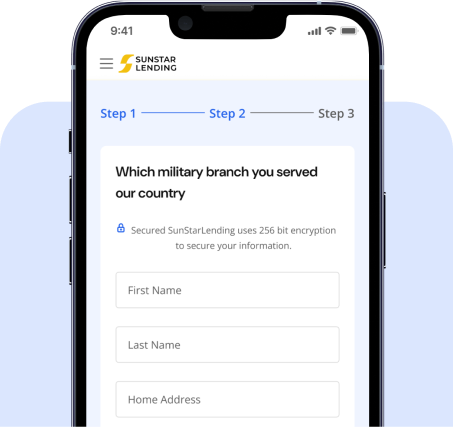

Fast & Secure Loan Approval

After consultation, you’ll receive a prompt decision on your loan. If approved, 99% of funds are transferred directly to your account within one business day. It’s that fast and simple! Start your financial journey today with SunStar Lending.

Simple and Secure Application Process

Submit your basic information through our secure form. Let us know the best time for us to reach out, ensuring our loan specialists connect with you at your convenience. your personal details are fully protected.

Personalized Financial Consultation

Talk to a loan specialist about your financial goals and explore loan options, terms, and rates. Get expert guidance on the best products for your needs. If you qualify, move forward with the application for approval.

Fast & Secure Loan Approval Decision

Receive your loan approval decision promptly. If approved, 99% of funds are transferred directly to your account within one business day. Start your journey to financial freedom today with LendXpress!

TESTIMONIALS

What Our Customers Are Saying

Read testimonials from our satisfied customers and see how SunStar Lending has supported them through their financial journeys.

SunStar Lending made the loan process simple and stress-free. The approval was fast, and the customer support team was incredibly helpful. I feel secure with my financial future now!

Alex M

I’m so grateful for SunStar Lending! Their flexible repayment options gave me the breathing room I needed, and the low rates made it affordable. The whole experience was smooth.

Jordan E.

The team at SunStar Lending went above and beyond to make sure I got the right loan for my needs. The process was quick, and the service was outstanding. Highly recommend!

Samantha T.

FAQ

Frequently asked questions

We’ve answered some of the most common questions to help guide you through the process. If you have additional questions, feel free to reach out to our team for more information!

What is a consolidation loan and how does it work?

A consolidation loan allows you to combine multiple debts into a single loan with one monthly payment. Instead of managing several high-interest debts, such as credit card balances or medical bills, a consolidation loan simplifies your finances by offering a lower, fixed interest rate and manageable repayment terms.

What types of debt can I consolidate?

You can consolidate a wide variety of debts, including credit card debt, personal loans, medical bills, and other unsecured debts. However, certain debts such as student loans or secured debts (like car loans) may not be eligible for consolidation.

Will a consolidation loan lower my monthly payments?

In many cases, a consolidation loan can lower your monthly payments by offering a lower interest rate and extending your repayment term. However, the exact savings depend on your current debt, interest rates, and the loan terms you choose.

Will consolidating my debt affect my credit score?

Initially, applying for a consolidation loan may result in a small, temporary dip in your credit score due to the hard inquiry. However, over time, consolidating your debt can positively impact your credit score by simplifying payments, reducing credit card balances, and helping you avoid missed or late payments.

Can I qualify for a consolidation loan if I have bad credit?

Yes, you can still qualify for a consolidation loan with less-than-perfect credit. While a better credit score may help you secure lower interest rates, SunStar Lending considers other factors, such as your income and employment history, to determine eligibility.

How long does it take to get a consolidation loan approved?

The approval process for a consolidation loan is typically quick and efficient. After you submit your application, it usually takes between 24 to 48 hours for approval. Once approved, the funds are disbursed directly to pay off your debts or into your account, depending on the terms.

Are there any fees associated with consolidation loans?

SunStar Lending is committed to transparency. There are no fees to apply for a consolidation loan. However, some loans may include origination fees or late payment penalties, which will be clearly outlined in your loan agreement. We strive to ensure that there are no hidden fees.

Can I still use my credit cards after consolidating my debt?

Yes, you can continue to use your credit cards after consolidating your debt, but it’s important to be cautious. The purpose of a consolidation loan is to help you manage and reduce your debt, so if you continue to accumulate high-interest credit card debt, it may undermine the benefits of the loan. SunStar Lending recommends using credit cards wisely to avoid falling back into debt.

BLOGS & ARTICLES

Our Latest News and Insights

Explore latest news and insights. Get our latest tips to stay smart about your money!

Subscribe for expert advice on managing debt and more.

Subscribe for expert advice on managing debt and more.

OTHER LOAN OPTIONS